The world of bitcoin and cryptocurrency is new and there is risk. There are many cryptocurrency services on the internet and many more coming online. Many have good intentions and unfortunately many have bad intentions. There is also the scenario where you use a good intentioned service that has attracted bad intentioned users.

I can understand if you are hesitant about using many services and with justified concern. So we are going to look at the risk points of the services we may use so we can make a more informed decision about the risk.

Being aware of things to consider will help you protect your funds. I have personally lost coins and had close calls along with watching a number of scams and opportunists try to prey on the unwitting. So hopefully this experience will help us reduce the potential risk.

In this post we are going to focus on being safe with using 3rd party services. Not all services are equal, as some are taking full control of your funds and others are pushing the boundaries of the technology to provide you with more peace of mind.

Objectives

– Some quick ways to research services

– Things we can do to protect ourselves

Research Potential Service Providers

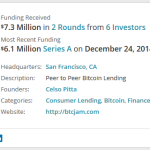

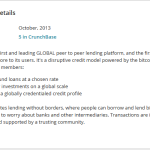

Find some information on the service you want to use so you know something about who you are working with. Try CrunchBase.com to see if they have the service in their database and if they do, they often have some good information and history on people.

Find some information on the service you want to use so you know something about who you are working with. Try CrunchBase.com to see if they have the service in their database and if they do, they often have some good information and history on people.

This will provide an indication of how transparent and forthcoming the service is with information. You can see when the company was founded and if and how much funding they may have had. You can often see the ownership and management team which you can drill down on to see what else they have been involved in.

If the service you are researching is not in Crunch Base then you can do a WhoIs search on their domain name to see when the domain was registered and to who. If they have blocked their domain name registration information or it looks fake, then this could be a red flag.

The BitcoinTalk.org forum can be a good place to see what others are saying about a service. It is a strong community where people often ask and discuss new services and experienced users will normally provide a fair indication of what the service is all about.

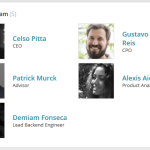

Scrutinize the service providers website. How transparent is the ownership, management and contact methods? Does the service have a detailed About page and Contact page? Can you see who owns and manages the company and their biography? Do they have a physical address and or office? Can you email or even better call them on the phone?

It may even be worth contacting them to make sure someone does answer and provides a quality response. Ask a few tricky questions 😉 They want you to trust them with your funds. Make them earn it.

Consider How the Service Works

After doing a little research on the service and who is behind it, you will want to take a look at how the service works.

Many services will want your bitcoin or other cryptcurrency upfront and want you to place the funds into a wallet they control. This is currently pretty normal, but that doesn’t mean it is safe, but services are starting to appear where you don’t have to give up so much control so quickly. But that is a more advanced topic for another time and involves features like “multi-signature“.

If you control the keys for your wallet then it is pretty hard for anyone else to take your funds. But if you put your funds into a service where they control your wallet keys, then you want to make sure you know how things work.

Seriously consider removing your unused funds from the service at the end of each day. If you are using a service where they control the private keys for the wallet, then please consider this.

The main reasons for removing funds are if the service is attacked by hackers, they could steal the funds or disable the service where you can not make a withdrawal. Or maybe for some reason overnight or during the week the operators of the service choose to stop and disappear without notice. The operators could be under political or legal pressure or maybe financial pressure or they always intended to run with the funds.

This is extra work and cost at the end of a trading session with any service. But it is like leaving cash at a friends house and hoping it is there when you return, you may trust the friend, but what about others that visit their house?

Start with smaller amounts. When starting with a new service you may want to test the water with smaller amounts before you commit too much of your capital. With peer-2-peer lending sites you are going to give your funds to a complete stranger in another country. Debt collection may not be as easy as with government issued currencies and regulated services. So to reduce and spread your risk by investing smaller amounts will provide valuable experience.

Summary

There is a lot to read here, but it covers a few simple due diligence items. As you gain more experience you will learn your own ways to vet services and investments. Please share the valuable experience you have had as it will make all of us stronger.

All Done!

Stock Image: gratisography.com